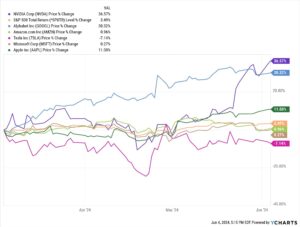

In the sprawling tech landscape of Silicon Valley, seven behemoths stand as the defining forces of the digital age: Apple, Microsoft, Alphabet (Google’s parent company), Amazon, Meta (formerly Facebook), Nvidia, and Tesla. These companies, often referred to as the “Magnificent Seven,” collectively represent over $10 trillion in market value and dominate not just their respective sectors, but shape the very future of technology. From artificial intelligence and cloud computing to social media and electric vehicles, these tech giants have transformed from ambitious startups into global powerhouses that influence how billions of people work, communicate, shop, and live their daily lives. The intricate process of securing a mortgage involves numerous factors that directly influence the final interest rate offered by lenders. Credit scores play a pivotal role, with higher scores typically resulting in more favorable rates. Lenders evaluate credit history, payment patterns, and overall creditworthiness to assess the risk level associated with lending substantial amounts of money.

Down payment size significantly impacts mortgage rates, as larger down payments often lead to lower interest rates. This occurs because borrowers who invest more of their own money upfront present less risk to lenders. The loan-to-value ratio, which compares the loan amount to the property’s value, becomes more favorable with larger down payments.

Property type and location affect rates considerably. Single-family homes generally secure better rates compared to condominiums or multi-unit properties. Geographic location influences rates based on local market conditions, property values, and economic factors specific to different regions.

Loan terms and structure shape the final rate offering. Shorter-term mortgages usually come with lower rates than 30-year loans, though monthly payments are higher. Fixed-rate mortgages typically carry higher rates than adjustable-rate mortgages initially, but provide long-term stability and predictability.

Income and employment history demonstrate the ability to repay the loan. Stable employment, consistent income, and a favorable debt-to-income ratio strengthen the borrower’s position. Self-employed individuals may face additional scrutiny and documentation requirements.

Market conditions and economic factors beyond individual control impact rates. Federal Reserve policies, inflation rates, bond market performance, and overall economic health influence the baseline for mortgage rates. These factors create the foundation upon which individual rate adjustments are made.

Lender competition and business models affect rate offerings. Some lenders focus on volume and offer competitive rates to attract more borrowers, while others specialize in specific market segments or loan types. Shopping among multiple lenders often reveals rate variations for similar loan scenarios.

Rate locks protect borrowers from market fluctuations during the loan process. The duration of the rate lock period affects the rate itself, with longer locks typically resulting in slightly higher rates. Careful timing of rate locks can save thousands over the life of the loan.

Points and fees impact the final rate structure. Borrowers can often choose to pay points upfront to secure lower rates, or accept higher rates to reduce closing costs. This flexibility allows customization based on individual financial situations and goals.

Documentation and verification requirements influence the rate-setting process. Complete, accurate, and timely submission of required documents can facilitate better rates. Delays or complications in verification may result in rate adjustments or lock expiration.

Understanding these various elements helps borrowers navigate the mortgage process more effectively and potentially secure more favorable rates. Each factor contributes to the overall risk assessment and rate determination, creating a complex web of considerations that shape the final mortgage terms.