The recent surge in technology stocks has sparked concerns among market analysts about potentially heightened investment risks. As major tech companies continue to drive market gains, questions arise about the sustainability of these valuations and the increasing concentration of market wealth in a handful of dominant players. This concentration, coupled with broader economic uncertainties, presents a complex landscape for investors navigating the current tech rally, warranting a closer examination of the underlying risks and market dynamics. Real estate investment trusts have become increasingly popular among investors seeking steady income streams and portfolio diversification. These investment vehicles allow individuals to participate in large-scale real estate ownership without directly managing properties. By law, REITs must distribute at least 90% of their taxable income to shareholders annually, making them particularly attractive for income-focused investors.

REITs operate across various real estate sectors, including residential apartments, office buildings, shopping centers, healthcare facilities, and data centers. This diversity enables investors to target specific market segments or maintain broad exposure to the real estate market. Each sector responds differently to economic conditions, providing opportunities for strategic allocation based on market cycles.

The structure of REITs offers several advantages over direct property ownership. Investors benefit from professional management, reduced liability exposure, and greater liquidity compared to owning physical properties. REIT shares can be bought and sold on major exchanges, eliminating the complexities and time constraints associated with traditional real estate transactions.

Market analysis shows that REITs historically demonstrate low correlation with other asset classes, potentially reducing overall portfolio volatility. During periods of inflation, real estate investments often maintain their value better than traditional fixed-income securities, as property values and rental income typically increase with inflation.

Different types of REITs serve various investment objectives. Equity REITs own and operate income-producing properties, while mortgage REITs provide real estate financing through mortgages and mortgage-backed securities. Hybrid REITs combine both approaches, offering exposure to multiple aspects of the real estate market.

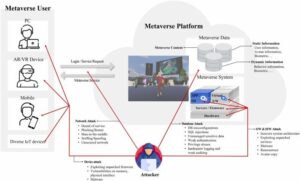

Risk factors include interest rate sensitivity, as rising rates can increase borrowing costs and potentially reduce property values. Market-specific risks, such as changes in local economic conditions or property oversupply, can impact individual REIT performance. Additionally, sector-specific challenges, like the rise of e-commerce affecting retail properties or remote work impacting office spaces, require careful consideration.

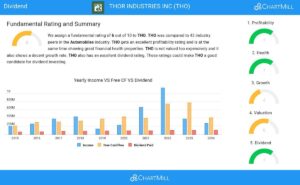

Evaluating REIT investments involves analyzing key metrics such as funds from operations (FFO), adjusted funds from operations (AFFO), and debt levels. The quality of property portfolios, tenant mix, and management track record also significantly influence performance potential.

Research indicates that REITs can enhance portfolio returns while providing regular income streams. The compound effect of reinvested dividends, combined with potential capital appreciation, creates opportunities for long-term wealth building. Understanding market cycles, sector dynamics, and individual REIT characteristics enables investors to make informed decisions aligned with their financial goals.

Tax considerations play a crucial role in REIT investing. While distributions are generally taxable as ordinary income, the tax efficiency of REIT structures and potential qualified business income deductions can benefit investors in various tax brackets. Consulting with tax professionals helps optimize investment strategies within broader financial planning objectives.